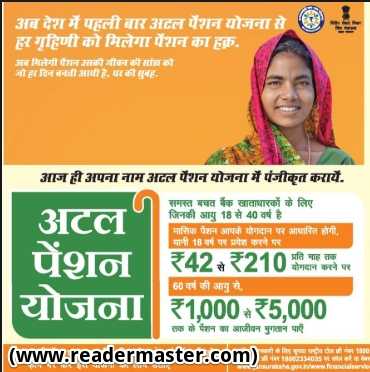

Atal Pension Yojana (APY)/ अटल पेंशन योजना

Atal Pension Yojana (APY)

The flagship social security scheme of the Government of India – Atal Pension Yojana (APY) – has completed five years of implementation and governed over 2.2 crore subscriber.

Key Points

Target Segment: The scheme was launched on 9th may 2015. with the objective of creating a universal social security system for all Indians. Especially the poor the under privileged and the workers in the unorganised sector.

Administered By: Pension fund regulatory and development authority through national pensions system (NPS).

Eligibility : Any citizen of India can join the APY scheme. The age of the subscriber should be between 18-40 years. The contribution levels would vary and would be low if a subscriber joins early and increases if she joints late.

Benefits:

It provides a minimum guaranteed pension ranging from Rs 1000 to Rs 5000 on attaining 60 years of age.

The amount of pension is guaranteed for lifeline to the spouse on death of the subscriber.

In the events of death of both the subscriber and the spouse the entire pension corpus is paid to the nominee.

Tax Benefits:

Contribution to the Atal pension YOJANA are eligible for tax benefits similar to the national pension system

Analysis:

The scheme has been implemented comprehensively across the country covering all states and union territories with male to female subscription ratio of 57:43.

However on;y 5% of the eligible population has been covered under APY till date.

Mee Bhoomi online AP RTC Land records Info